This past week, we’ve been digging into the proposed 2025 City of Chicago budget to closely scrutinize the revenue and appropriations in this year’s budget and determine what changes may be necessary. Here’s what we’ve learned so far!

Why is there such a large budget gap?

Almost half of the city’s revenue comes from sources controlled by the state, and the Administration has seen several significant decreases in specific revenue streams, including:

- Corporate Personal Property Replacement Tax (PPRT), which are revenues collected by the state to replace money that was lost by local governments when their powers to impose personal property taxes on corporations and other businesses was taken away. While these funds saw a record increase between 2020 and 2023, they are trending downward next year (for more on this, see this breakdown from the Center for Tax and Budget Accountability), resulting in a revenue loss of $169 million.

- Municipal Public Utility Tax: Utility taxes and fees are expected to decrease by $21.4 million from the 2024 budget. Weather, natural gas prices, and evolving technologies that affect consumer behavior and energy use may all be affecting net revenues.

- Leases, Rentals and Sales: The revenue from this source has decreased by half since the last year, which many have suggested is due to lagging Central Business District activities.

Why is there a proposed property tax increase and what would the impact be on my property tax?

What would the impact of the proposed property tax increase be for my taxes?

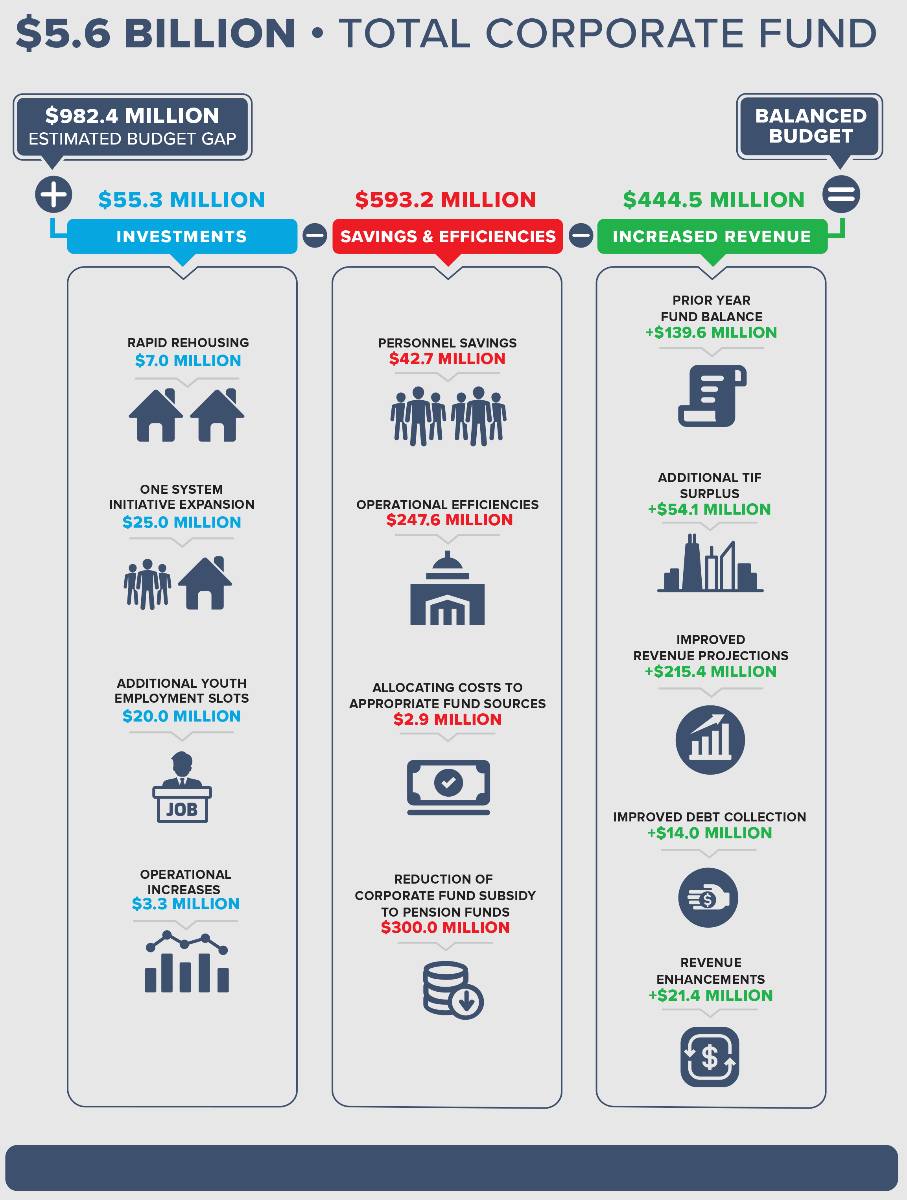

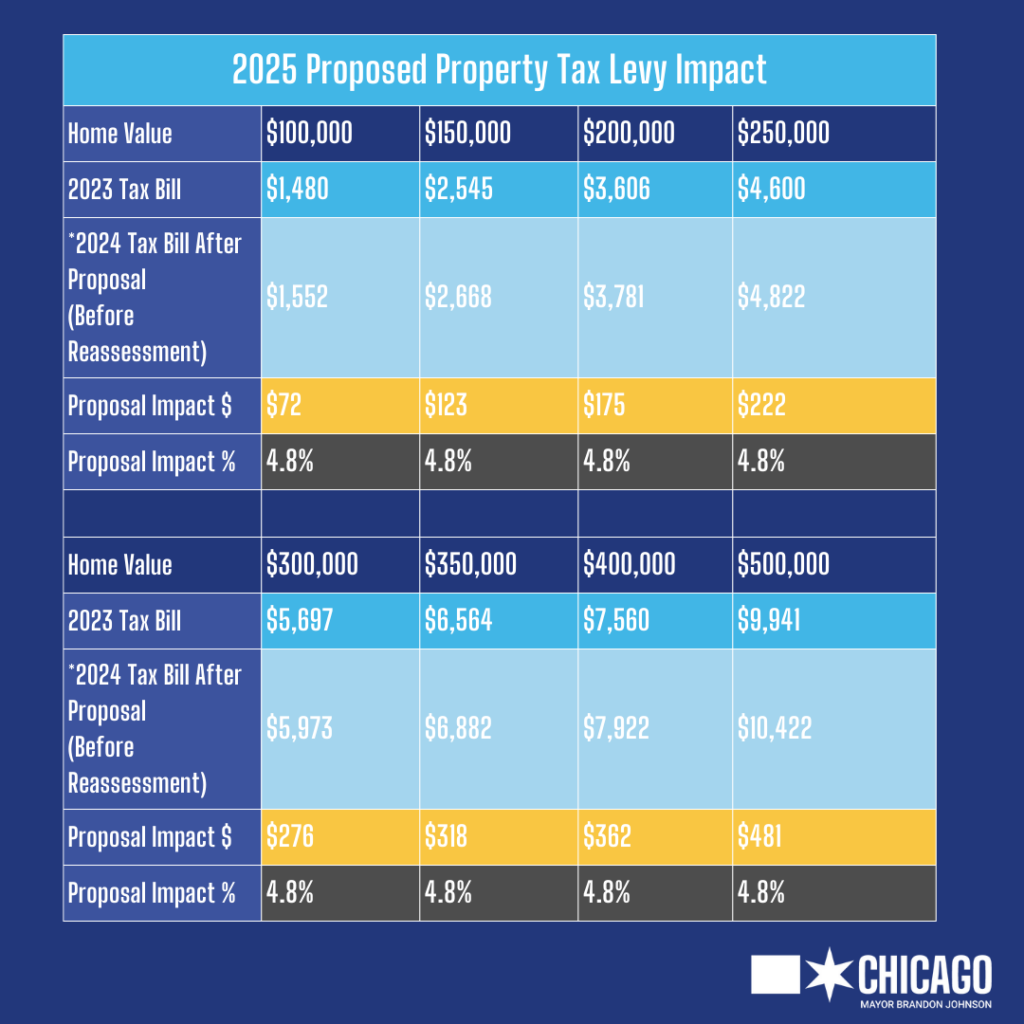

The administration proposed an increase in the property tax levy, for a projected $345.8 million in revenue to close the remaining the budget gap.

You can see the chart below for what the impact of the proposed increase would be:

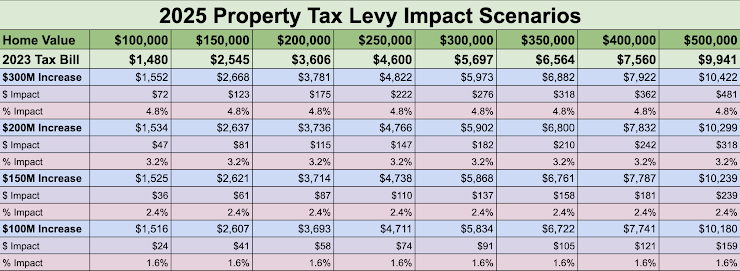

Below, you can also see a chart that compares the impact of the currently proposed $300 million property tax increase with reduced increases of $100, $150, or $200 million.

We know that many of our neighbors have already seen major increases in their property tax bill from the most recent county assessments, and are understandably worried about the impact of yet another increase. We share those concerns, as do many other members of City Council. 29 City Council members, including Ald. Vasquez, signed onto a letter calling for an immediate vote on the property tax increase next Wednesday.

What other sources of revenue is the City considering other than raising property taxes?

Here are some of the other notable projected increases in revenue sources:

- Liquor tax: the budget proposed an increase in the city’s liquor tax to keep pace with inflation, which would result in a projected $40.6 million in revenue.

- Municipal Parking: Residential parking permit costs will be increasing from $25 per year to $30 per year in 2025, and $35 per year in 2026––with the exception of senior residents, who will continue to pay the current rate of $25/year. The fee for daily guest permits will also increase from $8 per sheet to $15 per sheet.

- Grants: City grant funds are estimated to increase by $173M, which represents a 4% increase from 2024. While pandemic-related grants are expiring, capital grants under the Bipartisan Infrastructure Law (BIL) and Rebuild Illinois are helping to offset that reduction.

- Enterprise funds: the city’s proposed budget includes a 5% projected increase in enterprise funds—which are funds drawn from charges and fees related to the water and sewer system, and O’Hare and Midway Airports. These funds are self-supporting, which means that they are not paid for through tax revenue, but instead by revenue derived from fees for the services they support.

- Interest on Investments: The Treasurer’s changes in investment policy will allegedly net the city a 1557% increase in this fund; however, it remains to be seen what those policy changes are and if this projection will hold in actuals.

That said, City Council members are exploring other potential revenue sources other than property taxes, which you can learn more about and weigh in on some of those options in our 2025 Budget Survey!

What spending cuts are included in this year’s budget?

The current proposal includes a number of spending cuts to the city’s corporate fund, which is the discretionary fund through which the city funds all services that are not funded by either grants or dedicated local funds (e.g. the Department of Water management, which is self-funded through water and sewer fees, the Department of Aviation, which is self-funded through airport-related taxes and fees, and the Department of Transportation, which is funded largely by federal grants and transportation-related taxes and fees).

Every city department was asked to cut their budgets by 3%, and there were also several other cuts included in the budget:

- $150 million cut to the new arrivals mission. The line item for spending on new arrivals has been eliminated from this year’s budget, which is partially because far fewer migrants than projected arrived to Chicago this past year, Chicago this year than was projected, and partially a result of the city’s closures of migrant-specific shelters as they move toward a unified shelter system. The city is funding $40 million for an additional 3,800 beds to the shelter system to accommodate migrants currently staying in temporary migrant shelters; however, that still leaves $110 million that is going towards closing the budget gap.

- Reductions in the workforce. 744 vacant positions have been eliminated in the proposed budget, which allows for cuts in personnel-related spending––the city’s largest driver of appropriations–– without requiring layoffs. Some of the departments that will experience the largest reductions in budgeted workforce include:

- The Department of Technology and Innovation saw a proposed cut of 54 positions. We have some concerns about this, given that the DTI is charged with improving systems that are crucial not only for delivering city services—e.g. 311—but also for streamlining the various ways the city collects data, which is hugely important to deliver appropriate oversight and transparency to the public.

- The Chicago Police Department saw a proposed cut of 456 vacant positions that have remained unfilled. While this represents the largest loss of net positions, it represents a smaller portion of the total percentage of CPD’s workforce, (roughly -3%).

- The Department of Public Health saw the second largest percentage decrease and the second largest net loss of positions, at 124 positions. This decrease is mostly due to the loss of pandemic grant funding, and given the new administration, we have major concerns that federal funding to public health may see further cuts, and thus the city may need to shore up spending for crucial health services.

City Council members are currently scrutinizing the proposed budget for what other spending cuts may be possible without jeopardizing crucial city services.

What areas has spending increased in this year’s proposed budget?

This year, there has been an increase in overall appropriations—aka, expenses—of $315,995,980 compared to last year. While most departments’ budgets were cuts, some departmental budgets have increased because of either grant funds (which are paid the federal government or other entities, and thus do not impact property taxes) or contracted raises that were negotiated before this budget. Here are some of the departments that saw the largest increase in budgets this year, and where the proposed revenue to fund those increases is coming from:

- The Chicago Police Department increased its budget by $58 million. That number mostly represents increases in pay as negotiated by this year’s Fraternal Order of Police contract. Police department appropriations make up 48.5% of all budgeted corporate fund appropriations, an increase from 48% last year.

- The Department of Transportation saw an increase of $673 million. CDOT is self-funded through dedicated local funds (e.g. vehicle taxes) and federal grants, including the Bipartisan Infrastructure Law (BIL), so this increase will not impact the city’s corporate fund.

- The Department of Aviation also saw a proposed increase of $125 million. Like CDOT, the DOA is almost entirely self-funded by dedicated local funds (e.g. airport taxes and fees), so this increase will not impact the city’s corporate fund.

In addition to the above, the Administration is also proposing an allocation of $311 million to Chicago Public Schools––which will be paid for largely via TIF surplus funds––to assist CPS in meeting their obligation to reimburse the city for pension contributions for Chicago Public Schools (CPS) non-teacher staff.

Lastly, the budget proposal includes an advanced pension payment of $272 million, which is larger than last year’s advanced pension payment, and the main driver of the proposed property tax increase. More on that below!

What is the advanced pension payment, and do we have to pay it?

The advanced pension payment is a policy that was implemented in 2021 to pay future pension contributions in advance. This policy was instituted after decades of underpayment by past administrations, which left the city with ballooning pension-related debt.

Making this payment is necessary to maintain the city’s fiscal standing; neglecting to pay the advanced pension payment would jeopardize our credit rating and impact our ability to borrow to the tune of $400 million. Further delaying payments and driving up debt will only increase costs for taxpayers in the long term. However, it is possible that we may be able to reduce the payment amount without impacting the city’s financial standing, which City Council is currently looking into.

Our office also hosted a meeting with City Council members and the Center for Budget and Tax Accountability to consider alternate methods for meeting our financial obligation to the city’s pension, without relying solely on property taxes to fund advanced payment.

How can I look at the budget data directly?

If you want to dig deeper into the data, check out our budget by year and budget change from 2024-2025 tools. You can see charts of both revenue and appropriations city-wide both for this year and in year-to-year comparisons, and look at each department’s budget in detail.

We also recommend following these independent organizations for their analysis of the city’s budget, and breakdowns of each department’s individual spending.

How can I share my feedback on this year’s proposed budget?

Glad you asked! We want to hear your feedback to inform continued budget hearings and negotiations. Please fill out our 2025 Budget Survey to let us know what your priorities, concerns, and questions are for year’s budget!

On Thursday, November 21st from 6:00-7:30pm, we are also hosting a virtual 40th Ward Budget Briefing, where you can give your feedback in person! Ald. Vasquez and representatives from the Better Government Association will discuss the impact of this year’s budget, and take questions and feedback from the public. Register at bit.ly/40thbudgetbriefing!

In the meantime, you can continue to find weekly updates on the 40th Ward blog and follow us on Instagram for daily downloads of the hearings.