Confused about property taxes? You’re not alone. Here are some of the basics that can help you understand (and maybe even lower) your property tax bills.

How Your Tax Bill is Calculated

Your tax bill is affected by a number of different factors, like:

- If your property were to sell today, what would it be estimated to sell for?

- How do tax levies affect your bill?

- Are there any additional savings (AKA exemptions) available to you as a homeowner?

If your property were to sell today, how much would it sell for?

Your property’s market value is one of the most important factors in calculating your tax bill. Your tax bill is meant to be proportional to your property’s value, which may be very different from the value of the property when you first purchased it—especially if home values in your neighborhood have gone up in recent years.

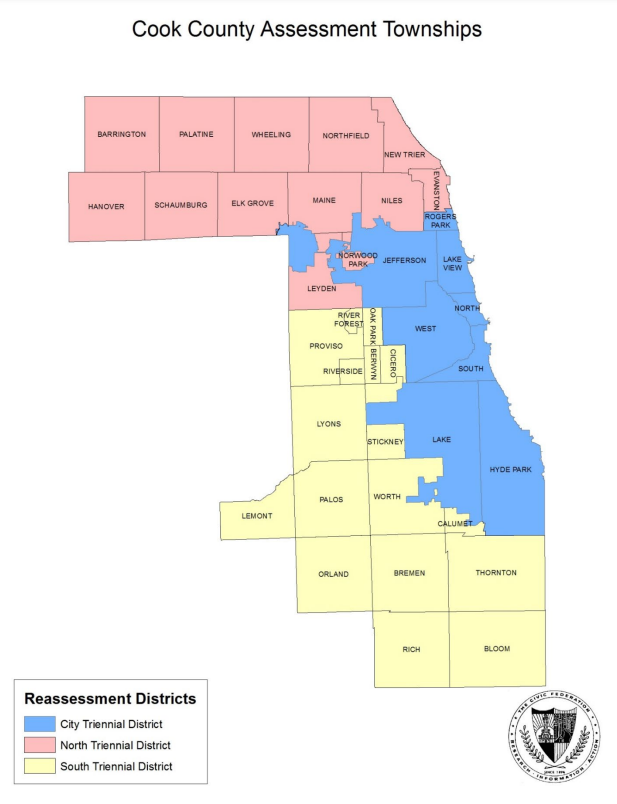

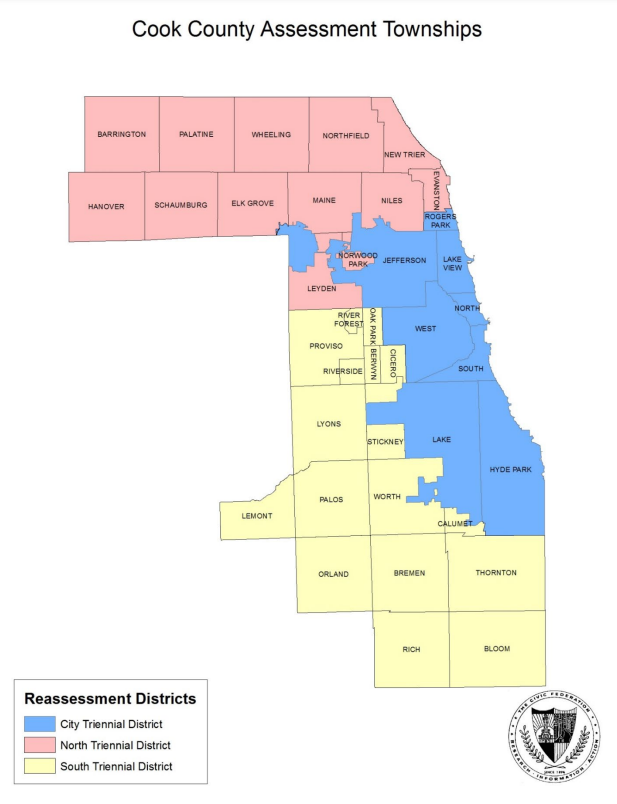

To determine your Market Value, the Cook County Assessor’s Office uses recent property sales of similar properties in your immediate neighborhood. This is called the triennial reassessment, and it is assessed every three years. These reassessments are conducted township by township. The City of Chicago is made up of 8 townships. The 40th Ward overlaps in part with 3 townships: Rogers Park, Jefferson and Lake View.

After the Assessor’s Office has calculated your market value, they mail a re-assessment notice that includes the new market value. While it is possible for property values in a neighborhood to fall, housing in our neighborhood has generally been in hirer demand, leading to increase in sales prices and therefore increases in property market values. You can view updated data on City-wide assessment data through the Assessor’s website.

If you receive a re-assessment notice for your property with a market value that you believe is too high—i.e., that your property would not actually sell for that amount—there are options for you to appeal your assessment!

How to appeal your tax assessment

- File an appeal with the Assessor’s office. Once reassessment notices are sent out for your township, you have 1 month to file an appeal. If you are a residential property owner for a building with 6 or fewer units, you are able to file your own appeal during that period. You can do so online using the Assessor’s website or in-person at the Assessor’s office or book a one-on-one appointment with the Assessor’s pffice.

- File an appeal through the Cook County Board of Review. The Board of Review is an independently elected body that can also re-evaluate your assessment. Typically, their period for appeals opens soon after the appeal period closes with the Assessor’s office. Visit their website here. Our neighborhood is represented by Board of Review Commissioner Samantha Steele, whose office also regularly organizes appeal workshops and events.

You can file an appeal with one office or both. Each office will either accept your appeal and lower your assessment by an amount they deem appropriate or will deny your request for an appeal and keep your assessment as it is. If one office denies your appeal, it’s still possible that the other may accept your appeal. It is also possible for your appeal to be denied by both or accepted by both. There is also an option to appeal to the State’s Property Tax Appeal Board (PTAB); however, it is more difficult to file those appeals and they are less likely to be accepted than appeals to the Assessor’s Office and Board of Review.

Not sure if your market value is reasonable for your kind of property in your neighborhood? Assessment data is publicly available and you can use tools from the Assessor’s office to find comparable properties (properties similar to your own based on neighborhood and property type) to make sure your assessment seems reasonable. If your assessment is much higher than similar properties, you may want to consider filing an appeal and listing those comparable properties as the reason for your appeal. For more information on comparables and a link to the search tool, visit the Assessor’s website.

How do tax levies affect your bill?

Unlike sales taxes, which have a percentage added on, your property taxes are calculated by determining what portion of your property’s value makes up of the entire taxing district’s total value. That fraction is then multiplied by the total tax levy (i.e. the total amount that the taxing authority is looking to collect).

Say the City of Chicago’s annual budget was $100, and they planned to fund the entire budget through property taxes. The City would then set the property tax levy to $100. If there are 100 identical properties in the City, all valued the same, they would each pay $1. Now, say there are 200 identical properties and the property levy is still the same, each would pay 50 cents. This is why building additional properties and adding density to the City can assist in lowering tax bills, by expanding the tax base.

Now what would happen if these properties were priced differently?

If there were 100 properties, 99 of them identical and 1 worth twice as much as all of the others, and the tax levy were the same, the standard house’s tax bill would be 99 cents and the twice as expensive home’s bill would be $1.98.

There is also a distinct difference in the taxes paid by commercial property owners and residential property owners. Because commercial properties are able to generate income using the property, they are taxed higher than residential properties. This is calculated by your properties Assessed Value as opposed to your Market Value. Commercial properties are taxed on 25% of their market value whereas residential properties are taxed on 10% of their market value. This taxable value is referred to as “Assessed Value”. While a residential property and commercial property might have the same estimated market value—say $100,000 —the commercial property would be taxed on $25,000 of the value and the residential property would be taxed on $10,000 of the value.

So what tax levies are you billed for?

Your property tax bill includes a line by line breakdown of the taxing districts your property is in and how much of your bill it makes up. In the City of Chicago, some of the tax levies include the City of Chicago, the Board of Education of Chicago, the Metropolitan Water Reclamation District, the Chicago Park District, and Cook County. Any changes to the tax levy are typically voted on by your elected officials for that body.

For the City of Chicago, a vote to change the tax levy is typically made in connection with the upcoming City budget, which is voted on in October or early November, ahead of the next year. These tax levies pay for important things like infrastructure upkeep, streets and sanitation, and emergency services. While the tax levy helps pay for necessary expenses, tax levy increases can make housing more expensive for homeowners and renters alike. That is why Ald. Vasquez and the 40th Ward team support an audit of the City of Chicago’s largest expenses, to ensure that the City’s tax levy is as low as possible without sacrificing City services.

Are there any additional discounts (AKA exemptions) available to you as a homeowner?

If you own and live primarily at your property, there are discounts available for your property taxes called exemptions!

There are exemptions available for homeowners, seniors, veterans, and people with disabilities. While the homeowner and senior citizen exemptions automatically renew, exemptions like the Low-Income Senior Freeze, which have an income requirement, require annual reapplication. You can apply through these exemptions through the Assessor’s Office. Applications are available online or can be done in person at the Assessor’s downtown office or satellite offices.

Low-Income Senior Freeze

While most of these exemptions can help reduce your property tax bills, the Low-Income Senior Freeze works differently. The goal of the Freeze isn’t necessarily to reduce property tax bills, but to instead keep total property tax bills around the same year over year for low income seniors. The first year someone receives the Senior Freeze, it freezes the assessment used to calculate their property tax bills so that as home values and assessments in the neighborhood might rise, seniors earning a household income of $65,000 or less won’t see a big jump in their tax bill due to a change in their assessment.

While Senior Freeze recipients will still receive a re-assessment notice every three years, it is usually not worth it to tile an appeal. Unless the appeal lowers your home’s value so much that it is lower than the value the property was frozen at, it will not save you any additional money.

What if you forgot to apply for an exemption that you qualified for?

If you missed the deadline to apply for exemptions before tax bills were issued, there is still tax relief available!

If you missed an exemption that you would’ve qualified for at the time, you can apply for what’s called a Certificate of Error. Like an exemption application, you apply for the exemption through the Cook County Assessor’s Office, which can be done online, via the mail, or in-person.

The Assessor’s Office will then review your application and determine if you qualified for the exemption and did not previously receive it for that fiscal year. Once it’s approved, they will send it to the Cook County Clerk’s office who will calculate how much money that exemption would have saved off of your previous tax bill and the Cook County Treasurer’s Office will mail you a check for a refund for that amount. It typically takes 4-8 weeks for a Certificate of Error to be processed and a refund to be mailed to the taxpayer.

Not sure what exemptions you’ve received in the last few years? You can search your property on the Cook County Assessor’s website here using the address or 14-digit PIN. You can view the last few years of exemptions under the Exemption History and Status Section. Because Certificates of Error are processed differently than Exemptions, they will not appear under the Exemption History section. To confirm you haven’t already filed and received a Certificate of Error for any previously missing exemptions, check under the Certificate of Error section as well.